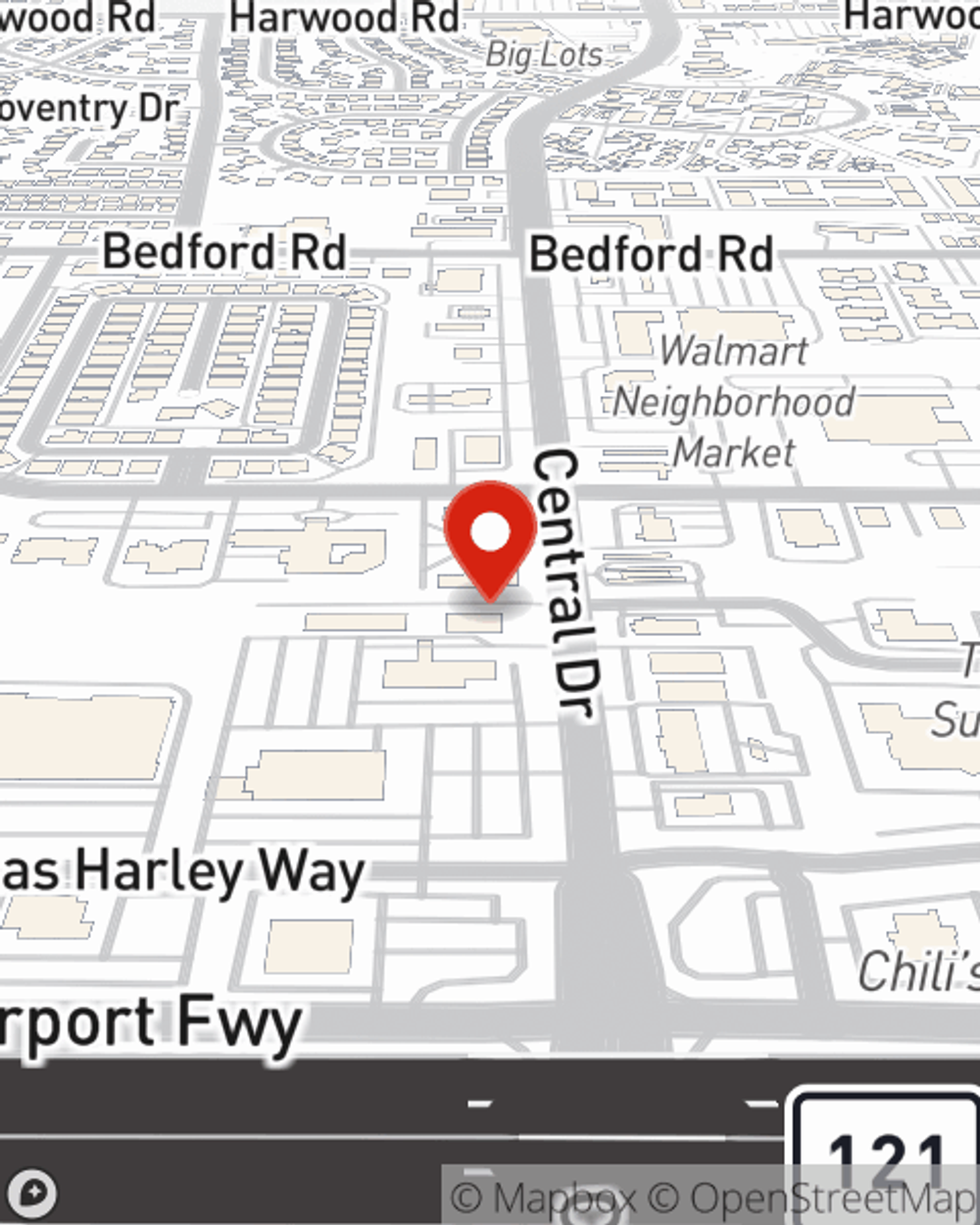

Renters Insurance in and around Bedford

Welcome, home & apartment renters of Bedford!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Your rented townhome is home. Since that is where you kick your feet up and rest, it can be a good idea to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your golf clubs, craft supplies, fishing rods, etc., choosing the right coverage can help protect you from the unexpected.

Welcome, home & apartment renters of Bedford!

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

Renters rarely realize how much money they have tied up in their possessions. Just because you are renting a home or space, you still own plenty of property and personal items—such as a couch, laptop, microwave, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why purchase your renters insurance from Kristie Polk? You need an agent who can help you choose the right policy and examine your needs. With wisdom and personal attention, Kristie Polk is waiting to help you keep your belongings protected.

Don’t let concerns about protecting your personal belongings keep you up at night! Contact State Farm Agent Kristie Polk today, and explore how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Kristie at (817) 267-1101 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Kristie Polk

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.